Fastenal Company $FAST NEW BUSINESS MODEL

Fastenal Company ( FAST ) is a company that provides inventory management services and sells industrial and construction products, The management is investing in new ways to help its customers and th

Fastenal Company FAST 0.00%↑

Description of the Company

The company is a distributor of supplies such as screws, fasteners, etc. To small and medium-sized companies and has more than 3200 branches worldwide.

The company has two types of operations:

· Branches are the traditional businesses where customers go to their stores and buy building products or industrial products. In this segment, the company expects a decrease in the future.

· Onsite this type of business has been implemented since 2014 and has been growing a lot in recent years; Onsite is a service for inventory management.

Business model and fundamentals

The business model of this company is very simple. The company is dedicated to selling products through its branches or offering inventory management services.

The company offers its products and services mainly to small or medium-sized companies in different sectors and not to individual customers, which is very beneficial for the company because it means that it can offer its services or products on a larger scale at a lower cost.

Branches

Branches are physical stores where customers go to buy the items they need. The company offers two types of services in its branches.

· Customer Service Branches (CSBs) This type of operation is a typical store where the customer goes and buys the products he needs and represents 35% of sales.

· Customer Fulfillment Centers (CFCs) This type of operation is for customers or companies that need a larger quantity of products where the company does all the logistical work for the customer, and is usually a large volume of products and represents 65% of sales in the branch office segment.

Source: Own Elaboration

Branches represent 61% of the company's net sales, but this % is expected to decrease due to the decrease in branches, but there will be an increase in CFC sales.

This means that there will be far fewer branches, but the few that the company considers being profitable will remain to satisfy CFC customers.

Source: Investor Presentation Q4 2021

Branches still represent an important income for the company, but the strategy is to reduce the number of branches and make them as profitable as possible.

Source: Own Elaboration

65% of branch sales are from CFC customers, and this is because it is much more profitable. After all, they are customers who place a large number of orders. This means the company has a decrease in its customer service costs.

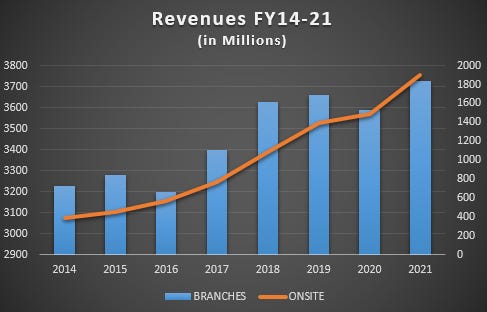

This is why since 2018, the branches have not experienced a great growth of only 3%.

LOCATIONS

Source: Own Elaboration

Source: Own Elaboration

Onsite sales in 2014 were $387 million and in 2021 were $1,898 million, a growth of more than 25% in 7 years.

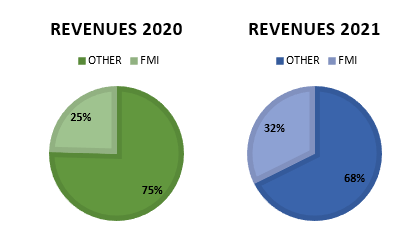

This segment The company manages the inventory of its customers and to perform this task it uses tools it calls Fastenal Managed Inventory (FMI), which are machines that help the company's employees to have better control over the inventory and distribute the parts the customer needs.

This segment represents 39% of the company's net sales and has grown by 25% in recent years and is expected to continue to grow. On-site locations are strategic points where the company manages and distributes the orders that customers need to stock their inventory.

Source: Own Elaboration

FMI

In 2008 the company decided to release a series of tools to help its customers with their inventory management so that they could be much more organized in their operations and inventory would be under control.

But in 2014, the company realized that it was much more profitable not only to offer these products. But also to offer the product and the inventory management service.

Source: Own Elaboration

Since 2014 the installation of these tools has had a growth of 10%, and this is due to the service and closeness to the customer; this subsequently brought a good reputation for the company

Numbers

The company's strategy to grow in the Onsite segment and the FMI business model is very profitable and high growth and this can be seen in the income operation in recent years. since 2016, it grows by 8%.

Source: Own Elaboration

Gross margins have not grown, and this is due to the constant expansion of Onsite operations, which makes the operation more expensive and prioritizes growth over lower-cost production, so gross margins declined from 50% in 2014 to 45% in 2021.

Source: Own Elaboration

Company 2016 generated $3,962 million in sales, and 2021 generated $6,010 million in sales. In 2016, it generated EPS of $0.86, in 2021 of $1.60, which means that in 5 years, the sales and profits almost doubled.

Returns

Source: Own Elaboration

The success of the company's strategy can also be seen in its returns, and in recent years they have been very good and better than those of its competitors; this is due to the Onsite and FMI operations, which are very profitable for the company.

Debt

Source: Own Elaboration

Debt levels are low at 0.1 Debt/Equity, and this is because the company is financed through the issuance of shares, which means that it does not have to pay much interest, and net income is much higher, which is why in recent years it has issued 2.5 million shares.

Management

CEO Compensation

Source: Salary.com

Daniel L. Florness is the CEO of the company and has been in his position since 2016. his employees describe him as an honest and hardworking person; since Mr. Daniel came to the company, the sales, margins, returns, debt levels have been better.

A sign of his commitment to the company is that more than 50% of his salary comes from the company's performance; this means that if the company performs better year after year, Mr. Daniel receives a bonus as compensation.

FMI 2020-2021

Source: Own Elaboration

These inventory management tools are very important for this business model because they represent 32% of the company's total sales. Since 2020, the company investing in new ways to grow in this segment (FMI)

Inventory management not only requires FMI machinery but also requires a close relationship with the customer to know what they need.

Inventory management brings many benefits to customers, such as reducing costs, reducing the risk of stock-outs, saving time and money, this is why the company decided to implement more advanced technologies such as software, where the employee has more control over the inventory, and can also give a better report to customers about the inventory.

Digital Footprint

In 2020 the company decided to implement new ways to increase its Onsite and FMI operations and decided to increase its E-commerce operations by reducing infrastructure and branch maintenance costs.

Managers also decided to invest in new ways of operating their customers' inventory and decided to implement data as a new way of managing inventory and called this new business strategy the "Digital Footprint".

Data is one of the company's new initiatives, data implements new technologies such as software that stores data to help the customer have better control over inventory.

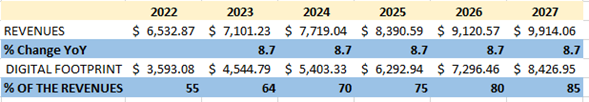

Source: Investor supplementary information

I extracted this chart from the annual report where the company expects to earn $10B in the next few years, and 85% of those sales will be from its new "digital footprint" initiative. If this new business model becomes a success for the company, it could be a great investment opportunity for the company.

If the company automates its operations much more, it can offer a much more economical service without having to lower its margins, which can be achieved with inventory management software.

Digital Footprint has grown from representing 37.2% of the company's sales in 4Q20 to 46.4% in 4Q21.

E-commerce is also part of the digital footprint because, in the future, the company also expects to have a growth in online orders. These orders will be mostly from small businesses that need a higher quantity of units per product and in a faster manner.

LIFT or local inventory fulfillment terminals are small distribution facilities located in a dense population of FMI devices.

The reduction of branches at strategic points or LIFTs seeks to have only a few branches and supply customers in need of fasteners, bolts, nuts.

I think this initiative of the company makes a lot of sense because it not only seeks to reduce costs but also to provide better service with greater control over inventory.

DIGITAL FOOTPRINT ESTIMATES

Source: Own Elaboration

The Management estimates that in the next few years when generating $10B in revenues 85% of those revenues will be from a digital footprint.

If we estimate with this information and the fact that sales in recent years have grown by 8.7% annually and that the digital footprint in 2021 represented 46.4% of sales, we can estimate that By 2027, it is possible to reach the goal of the board.

Source: Own Elaboration

The progressively digital footprint would represent year by year a higher % share of sales

Market

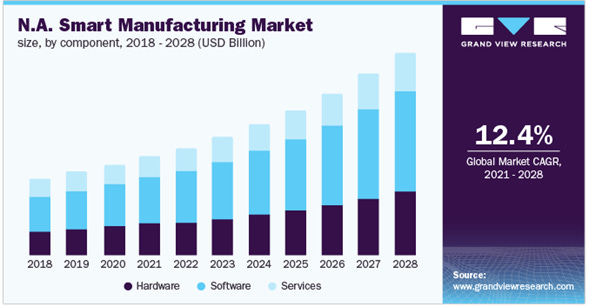

The manufacturing market is the market where the company mostly offers its services. The growth of this market may be in a way beneficial to the company.

according to Gran view Research

The global industrial fasteners market size was valued at USD 86.12 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2021 to 2028.

Source: Grand View

The industry is looking for new ways to reduce costs and produce larger quantities in the next few years. The industry is starting to implement new ways to manage its operations and the company knows it can take advantage of this.

Over the next few years, the sector is expected to grow by more than 12%. The manufacturing market is considering that their inventory is one of the biggest problems in their operations and managing that inventory is much more expensive. Companies like Fastenal are taking advantage of this trend to offer great service and continue to grow.

Source: Global Market

In the coming years, the software market is also expected to grow very well, and the company plans to take advantage of this trend to continue growing and offering better service, this market is expected to reach $5B in the next few years.

Risk

The company can be affected by how the manufacturing industry is doing and this can be a risk for the company. The inventory management industry is becoming more and more competitive and some competitors have greater resources than the company and a much larger infrastructure with greater capabilities.

The future expectations of the company's management may not be fulfilled or resources may not be well managed.

Competitors

Source: Own Elaboration

The company competes with several manufacturers for manufacturing products, but its major competitor in inventory management is W.W. Grainger, Inc. Grainger, Inc. (GWW) company has better P/E, FCF, and EBITDA valuations, but a very different business model.

Grainger manages orders for its customers, which means that it provides support so that the order of bolts or nuts reaches its customers, and they do not have to pay higher costs in transportation or logistics for the other hand, Fastenal with its Onsite model provides a constant 24/7 service with personnel that is in charge of managing the inventory of the customers.

Debt is a factor to consider when a company is doing business and Grainger has much more debt than Fastenal which makes it easier to predict how the companies will perform in the future.

Source: Own Elaboration

The company has one of the highest P/E valuations in the sector, and this is due to the quality of the company, its revenue growth, good operating margins, and no debt make it one of the most followed stocks in the sector.

Outlook

P&L

Source: Own Elaboration

If the company succeeds in carrying out its expansion plan and new ways of providing its services, I believe it can continue to grow at a rate of 10% per year and have operating margins of 20%, as it has been doing so far.

Due to the company's business model, I estimate that by 2026 the company will continue to have good growth due to its strategy and the growth of the sector, which is why it will generate $1441 M of income in 2026. and its sales will grow by 10%.

Rating

The company has an ROE of between 25% and 20%, Very good profitability that has remained stable in recent years. This profitability generated by the company has driven EPS from $0.86 in 2016 to $1.60 in 2021

Source: Own Elaboration

Summary of valuation methods

Source: Own Elaboration

The company has historically traded at an average P/E multiple of 17x and currently trades at 30x, a very high multiple and this is because it is a company with very good margins and growth and almost no debt.

Being a company that generates a lot of value over time, it should be valued by P/E offering us an average of about $76 ($1471M in income for 2026 multiplied by 30x = $44.1B or $76) per share today. A 31% upside may seem very low, but if it can continue to provide a good service and innovate, it can reach that price.

Valuing by the P/E multiple is much more appropriate in this company due to the company's high margins and the growth that the company is expected to have.